Whistleblower Releases Audio, Files Complaint: Cites Medical Billing Plot at Optum

Opinion Advocates for ideas and draws conclusions based on the author/producer’s interpretation of facts and data.

This is the 14th installment in an ongoing investigative series, launched in December 2022, about CareMount/Optum/UnitedHealth and broader concerns about corporate healthcare.

FLEECING THE FEDS

Local Unionizing Effort Intensifies, Yorktown Workers Poised to Vote Next Week

- Plot on Tape

- Insider Revelations

- DOJ Investigation

- Corporate Greed

- Privacy Breach

- Leadership Vacuum

- Unionization Surge

By Adam Stone

(Listen to the audio recording above)

After my last piece in this series in February uncovered a Justice Department probe into UnitedHealth/Optum over alleged anti-competitive practices at the publicly-traded behemoth, gaining coverage in national outlets like The Wall Street Journal and Bloomberg News, I’ve been inundated with messages from sources across the country elaborating on the company’s grotesque internal behavior.

Yet there’s just way too much new detail to share in one newspaper column, even one the length of several book chapters.

I’ll focus today on one startling revelation, and also showcase a separate, potentially game-changing grassroots development in our backyards.

The revelation involves grave concerns cited by a whistleblower about an alleged local Optum Tri-State strategy to manipulate patient diagnoses and secure more revenue by bilking the federal government through value-based incentive compensation via the Centers for Medicare & Medicaid Services, or CMS.

As for the encouraging signal, it’s a currently unfolding unionization effort at various local facilities, with a vote scheduled for next week, on Mar. 26, in Yorktown.

While some observers might harbor mixed feelings at best about unions, the disgraceful behavior by management has been begging for a reaction, and labor organizing is what muscular pushback looks like when boxing a corporate brawler.

But let’s review the alleged profits-over-patients scheme first.

Plausible Deniability

In short, value-based incentive compensation is designed to reward providers for delivering quality care.

But, according to an insider, executives within the Optum Tri-State/Optum East organization are actively planning to add more misleading diagnostic codes to patients’ records, lacking the necessary supporting evidence from labs or radiology reports.

“This approach not only raises ethical concerns but also has the potential to compromise patient care and integrity,” a company source from the administrative side of the operation e-mailed me last month, before our first interview.

In fact, the source provided me with an audio, available on our website, where you can hear internal deliberation at a Jan. 26 remote meeting, held over Microsoft Teams.

My source described their view of the conversation’s subtext among the participants; the insider says decision-makers know they’re straddling a fine ethical and legal line.

Subtle communication cues, the source said, are vital to executing the alleged scheme in a manner that seems to allow for plausible deniability.

(Listen to the released audio recording here)

Lordy, There are Tapes

Nudging well-meaning doctors to embrace the strategy would have to be a delicate dance.

It might entail reminding skeptical physicians about CMS language that could provide credible cover for specious diagnostics.

A source estimated either 14 or 15 people at the meeting – identifying eight or nine nurses, a trio of administrators, a physician, Dr. Kevin Baran, and a pair of higher-level executives: Optum East Director of Clinical Documentation Education Rachelle Gauvin and the Vice President of Risk Adjustment Cristy Bauer, who the whistleblower said reports to President of Risk Bearing Entities Alyssa Pepper.

The source said the purpose of the meeting was to counsel nurses on how to incorporate additional medical conditions – and thus additional billing codes – from existing data on patient charts, even though some conditions might obviously resolve in time.

“Maybe,” one Optum East executive offered in the Jan. 26 meeting, “new providers would need even a higher level, maybe a clinician-to-clinician conversation about [saying something like], hey, ‘We presented this supported medical condition to you, and you disagreed with it. Let me explain to you what the CMS definitions are around the condition, and then I’d love to hear more about why you felt it might not be appropriate for this patient.’ Right. And that’s how kind of those conversations will grow.”

My source said some people within the corporation know they’re breaking the law – outright fraud – while others believe they’re skating inside the legal lines.

But the insider characterized even that less malevolent behavior as violating the “abuse” portion of the federal government’s efforts to mitigate “fraud, waste and abuse” in the healthcare industry.

“Some are knowingly committing this and know this was wrong and did it anyway and others are abusing the system – they think they found a loophole – and that is still wrong, that is abuse,” the source declared when we met in person for the first time last week.

Room Where It (Unfortunately) Happens

Participants at the taped meeting talked about “buddy codes” – the notion of linking one medical condition with another.

A nurse appears to subtly question the plan, asking higher-ups where in CMS the language related to buddy codes even exists.

“Is there a place on CMS where we can find what’s considered buddy codes, or is this something that y’all have generated up?” the nurse diplomatically asked.

An executive then replied: “Not all generated up, but yes, we’ll get you a list of how they tie together.”

In response to the nurse’s inquiry, Baran (a physician who also serves in a management capacity) quipped about it being a “Baranism.”

“No one else will know what you’re talking about outside of this room,” the doctor said.

He also noted how “they don’t use the word buddy code,” but there’s “a different tool” that Bauer, the risk adjustment vice president, would ultimately be able to provide as guidance.

The conversation sparked some gentle, perhaps nervous laughter over the seemingly exotic, homegrown nature of the scheme.

Drivers and Passengers

At one point in the conversation, an executive appears to tacitly acknowledge the potential unease among nurses about the plan.

“So I know that’s a different way of looking at things for all of you,” she said to them. “What do you think about that?”

My source stressed how many people in the meeting (Gauvin and Baran included) are, broadly speaking, just passengers on the ride, not captains of the ship, stuck inside the corporate vortex, navigating the system. The whistleblower believes they might be decent enough people but, either way, are unambiguously complicit.

Some plot participants might conclude they’re painting just within the legal lines in order to boost business.

“If you continuously inflate these conditions and fluff up these conditions, it obviously raises the money,” the insider said. “You get to take care of said patient, but it also increases your profit.”

Yet as the whistleblower explained it, any attempt to resurrect old patient maladies into current billing is unambiguously bad practice on its face.

“If you had atrial fibrillation in 1989, how is it relevant to a current visit?” the source pointed out this past weekend at our second in-person interview.

‘That’s Fraud’

When I interviewed the insider on the phone two weeks ago, before we first met, I asked for additional specifics on how executives might be plotting to push misleading diagnostics on patients in order to drive revenue.

“By giving patients a diagnosis of autoimmune deficiencies and hyperaldosterone,” replied the source, who requested anonymity, fearful of the corporation’s wrath. “Their assessment is that if a patient is on a medication, any medication that might lower their immune system, they have this automatically. That is not an assessment. Right? That is not a real true assessment.”

I asked a different former Optum executive for their take about the allegations. If a patient suffers from rheumatoid arthritis and takes medication to address the symptoms, the drugs can impact your immune system, the source noted.

“But does [the patient] have an autoimmune disorder? No,” the former executive explained. “So if that’s what they’re doing, that’s fraud.”

Multiple insiders said finance-focused executives generally don’t care if physicians are performing labs to confirm if patients are, say, genuinely autoimmune.

And it’s important to keep in mind the relevant business context: The Optum Tri-State unit, based on sources cited in my piece last month, has not been performing financially up to corporate standards through last year, and local executives are said to be desperately scrambling to identify ways to expand revenue by about 9 percent, hence the alleged disingenuous diagnosing scam.

“By doing this, and then, of course, submitting these payments or these charges to Medicare, that’s fraud,” said the whistleblower, who qualifies for what’s known as “qui tam,” a legal provision allowing private people to sue on behalf of the government or testify or assist in investigations.

Filing a Complaint

Eager to stop the company from proceeding with the dangerous alleged plan, the whistleblower filed a complaint last month with the Office of the Inspector General (OIG) through the U.S. Department of Health and Human Services (HHS).

“Hotline tips are incredibly valuable, and we appreciate your efforts to help us stamp out fraud, waste, and abuse,” a Feb. 23 form e-mail from the OIG stated to the source, confirming receipt of the complaint.

The source detailed the three steps deployed in the plan to fleece the federal government in the company’s search for grey areas in Medicare guidelines.

- First, nurses are charged with reviewing patient charts, identifying chronic conditions referenced in past visits in a member’s health history (even if years old) and then inserting the detail into the patient’s records, resurrecting prior medical issues into an active problem list.

- Second, try to keep providers inoculated: a patient comes for a visit for a specific new issue; the doctor treats the patient, closes their notes on the case and locks it.

- Step three is where it gets super shady. A coder, usually offshore in India, reviews the chart, identifies a plausible code that had been inserted by a nurse (one that was not addressed at the doctor’s visit) and submits the allegedly fraudulent claim to Medicare, without physician involvement.

“This is just flat out wrong, this is illegal,” my source said when we first met last Thursday afternoon at a local coffeehouse.

There are about 90,000 diagnoses codes, and nearly 8,000 for risk adjustment. When medical operators surface those riskier 8,000 conditions in billing, they make more money.

When I met the whistleblower for a second time over the weekend, I asked about the poor nurses stuck in the middle; some are trained in coding but most are not, the source stressed.

“They just have no place to go and they have to conform,” said the insider, sharing how a local nurse was recently advised by a top former executive to “conform or leave.”

The Hartford Plan

In fact, corporate officials in risk adjustment already installed the deceptive diagnostics plan at Optum in Connecticut, my source explained, noting how the effort has been seriously successful in expanding revenue.

“What I’m trying to get the OIG and CMS to perform is an audit on that region in Hartford, Conn., because then they would see what I’m referring to,” the whistleblower said during a phone interview. “The increase of a condition that patients may or may not have. So they’ve already implemented this, and they recognize that it works for them, and they’re trying to put this across the board, across the region, across [Optum] Tri-State.”

Around here, the facility we previously called CareMount Medical (and MKMG/Mount Kisco Medical Group before that) became part of Optum Tri-State in 2022, bringing together Riverside Medical Group, CareMount and ProHealth Care.

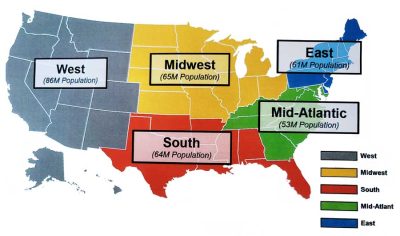

However, Optum Tri-State, the source said, has since been folded into Optum East. (The company maintains aggressive plans to grow across its already massive cross-country footprint throughout the vast U.S. market, with Optum West, Optum Midwest, Optum South and Optum Mid-Atlantic.)

What’s struck me as I’ve dug deeper into these issues is how the entire framework for Optum’s very existence (Optum, a UnitedHealth subsidiary, was started in 2011 by the insurance giant) seems to rest on an ugly half-truth.

Here’s the thing: Corporations shouldn’t be running healthcare organizations. And yes, physicians help lead these groups.

But everyone on the inside (and many on the outside) know it’s largely a construct to allow corporate captains to really steer the bigger ship.

It’s also worth noting that the well-meaning doctors performing life-saving work inside of Optum are not generally well-schooled or focused on the technical business side of corporate operations.

“These physicians, the guys who might run this, their background is clinical,” my source emphasized. “Understanding the laws and the rules and regulations behind billing and coding and reporting, they do not know, or they may not know it down to a detail that a person like me might have.”

Culture Club

Here’s another way corporate pressures are complicating the work of doctors, and opening them up to lawsuits. Let’s say a patient comes in for a standard visit, and the provider asks what medications she’s on. The patient, for example, shares that she takes Ambien for sleep issues.

A physician might now feel pressure to classify the patient as being “sedative dependent” on the medication (as opposed to just using it for clinical purposes) in order to display more risk, thus generating bigger billing dollars.

This allows the company to code the patient in a more profitable manner, within the context of risk adjustment, but misleading classifications could carry ramifications for patients, such as potentially losing their driver’s license.

(An area CareMount/Optum doctor is being sued by a patient in a similar case.)

As patients grow more cognizant of these issues, they might grow understandably wary to share key details of their health history with doctors.

In terms of the executives, many are certainly fine folks in their personal lives, and some might be trying their best to do right within the constraints of the company’s rancid culture.

But I wanted to gain a better understanding of what makes people tick within the organization.

What’s driving the particularly insidious behavior, even by large corporate standards?

‘Corporate Greed’

At the end of the day, the culture largely encourages self-preservation, without any genuine attention to holistic patient health, scores of sources told me.

“So I put you at the helm of Optum Tri-State, your main job is to show profit year over year,” one administrator stressed. “If you don’t do so, the leadership at Optum is going to find another person with the same MBA, the same credentials to fill that need and replace you.”

Several sources said the idea of framing internal conversations around what serves patients is not even on the distant radar screens of many corporate leaders.

Starting any policy dialogue in that mission-based fashion, they say, would produce eye rolls at best.

Your care is just a widget.

Prioritizing compassion, within the context of financial sustainability, is just not infused within the spirit of the internal language at UnitedHealth/Optum – or in much of for-profit U.S. healthcare. (Most other developed nations offer some form of universal healthcare, executing with different degrees of success while navigating various challenges.)

“At the end of the day,” one administrative source put simply, “it is corporate greed.”

Denial of Care

I also interviewed a former Optum executive who elaborated on the prevalence within American healthcare of questionable coding practices, including the manipulation of medical codes to inflate revenue, known as upcoding. (Kaiser, for instance, has faced similar allegations.)

“If you code things at a more complex level than that patient actually exhibits, that’s fraud,” the source said.

Busy doctors, generally speaking, hate the coding task, and are just trying to get the work done and focus on patient care.

I asked the former executive if physicians, while undoubtedly facing exceedingly tough circumstances, should be expected to do more to resist corporate pressures?

“I think that what I’ll say in terms of the Optum model is the docs should have a partner in the office consistently that is making sure that coding is being done and that they are compliant with CMS standards,” the former executive replied. “Yes, you need to code. Coding needs to be comprehensive in order to get paid. We understand that. However, we want to make sure that it’s being done in a compliant manner consistent with how the patient presents.”

As for local access issues, the executive said the former CareMount facilities simply don’t employ enough doctors, which has its roots in a variety of systemic issues.

But the bottom line is that patients should be able to gain access to primary care doctors within 10 days tops, according to industry standards adopted even by Optum, the former company executive stressed.

The wait for many local patients is often at least three months – frequently far longer.

“So there’s a phrase that nobody in healthcare wants to hear, and that is denial of care,” the former executive said in our phone interview. “And basically, what Optum is doing is they’re denying care to members when they’re saying it’s going to be six months to a year; that is an outrage. And I’m just going to say that’s denial of care. If I had that happen, I’d be making some calls.”

Hungry, Hungry HIPAA

The former executive also described a growing national concern around problems with patient privacy.

Medical information is required to be safeguarded by law, through the Health Insurance Portability and Accountability Act, better known as HIPAA.

But there’s mounting unease over the way companies are handling our data.

“The other thing that is happening, and it’s happening on kind of a national level, is there are medical records that are being offshored,” the source said. “And when things go offshore that are specific to medical records, that’s in direct violation of HIPAA.”

As chance would have it, shortly after my interview with the former executive about HIPAA, I heard from a local patient, Poughkeepsie’s Loretta Spence, who had just received a link from Optum, over e-mail and text, about her mammography results, seeking her agreement to troubling terms.

“I acknowledge and understand that the result message is not encrypted or otherwise protected, and that there is a risk of a violation of my privacy, which may include my personally identifiable health information being accessed or viewed by an unintended third party while in transit or when stored on your mobile device, or by hacking or some other means,” the warning from Optum stated last week.

You have to agree to those unnerving digital terms to obtain your medical results?!

“It seems to me that Optum does not want to pay for encryption software,” Spence said.

The tension between UnitedHealth and the federal government also grew more public last week as Andrew Witty, the CEO, visited with senior White House officials on Tuesday, as first reported by The Washington Post, addressing a recent cyberattack that continued to affect provider payments.

Administration officials called upon Witty and fellow leaders in the industry to increase emergency funding for impacted providers, according to press reports.

“Once the U.S. Department of Health and Human Services (HHS) was notified of the cyberattack on Change Healthcare systems on February 21, 2024, HHS acted to address the impacts,” a statement from the HHS press office noted last Tuesday.

(In 2022, the DOJ unsuccessfully tried to stop the $13 billion deal that allowed UnitedHealth to acquire Change Healthcare.)

Ask the Analyst

Last week I also connected with Grace Totman of Capstone Healthcare, a global firm that advises large companies about the regulatory landscape.

Totman is director on the healthcare team at Capstone, and consults private equity firms, hedge funds and corporate clients on investment strategies and mergers and acquisitions; my piece last month that exposed the DOJ investigation based on internal documents had caught her eye.

Totman highlighted the fact that insurers and providers like United Health/Optum get paid what’s called a capitated amount (a set fee) based on projected healthcare costs.

“The theory is that patients with many chronic conditions are more expensive, and that, therefore, UNH/Optum should get paid more for taking care of them,” Totman explained last week. “However, this creates an incentive to diagnose as many conditions as possible. We’ve seen UNH/Optum and other insurers/providers become extremely skilled at maximizing diagnoses, and therefore risk scores and payments.”

If the government is going to seek remedies, the approach might have to be surgical, with something like a state-by-state approach.

“I spoke to a lawyer last week who had an interesting take that basically said I think the result of this is, okay, in New York, United/Optum can no longer purchase primary care providers, and we’re going to instill a $100 million fine for the double billing and specific practices there,” Totman recounted in a phone interview. “In Oklahoma, Optum can no longer purchase any nursing homes, and we’re going to impose a $50 million fine. It’s interesting to think about how it could be piecemeal because the local versus national plays such a role.”

Speaking of which, it’s hard to know which medical facilities acquired by Optum are displaying bad behavior that is indicative of the corporation’s influence versus bad behavior that was already infused within the DNA of longtime operations.

Here locally with CareMount, many patient concerns predated Optum’s entry into the market, even though symptoms have grown considerably worse over the past two years.

One other administrative source shared details with me about shenanigans at Optum’s New Jersey operations, with a unit “knowingly billing Medicaid and Medicare for procedures that were not completed or done correctly.”

But some company units, the source explained, operate like “insular fiefdoms.”

State of the Union

As for the local unionizing efforts, I obtained a National Labor Relations Board (NLRB) Notice of Petition for Election that alerts Optum Medical Care employees at the Yorktown office to 1199SEIU United Healthcare Workers East’s petition for representation.

The petition says the effort applies to all full-time and regular part-time employees including per diem workers at the 355 Kear St. location in Yorktown Heights, but excludes physicians, dentists and “confidential employees, guards, managerial employees, and supervisors as defined in the act.”

I interviewed a central figure in the organizing effort two weeks ago.

Wages are a concern – a recent 1 percent raise was viewed as a slap in the face – but the source said employees are also fighting for patients.

The longtime local healthcare worker is keenly aware of the ongoing complaints about the inability of patients to reach the office by telephone.

“We’re doing this to increase patient satisfaction and staffing,” stated the source, who requested anonymity but is ready to go public after next week’s vote. “And I’m sure everybody knows about our phones because I hear it every day.”

In addition to higher wages, will the union also fight for the hiring of more employees to fill some gaping personnel voids that impact patients?

“Absolutely,” the source replied in our phone interview, “we won’t have a problem [in the future] with staffing.”

Brewster Battle

Last year, Optum employees at a Brewster lab/warehouse took the lead, with workers voting to form a union with 1199SEIU.

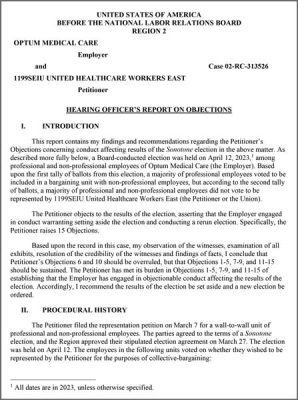

My source said the organizing was met with intense union busting efforts by the corporation, and the NLRB ruled against Optum Medical Care management for interference in the union election.

“I can’t even tell you the amount of intimidation,” the source stressed in a phone interview. “They did horrible things to them. I just heard on a Zoom meeting the other night what exactly they did to them, and it was disgusting. They didn’t even have a working bathroom. They were told to go across the street.”

On Oct. 24, 2023, in a complex, detailed 32-page ruling available on our website, NLRB Hearing Officer Elise Oviedo sided with the workers in multiple areas, and recommended “the results of the election be set aside and a new election be ordered.”

“They had to go to the federal labor board, they had to go to the appeals court,” my source remarked about the Brewster battle, which involved more than 100 workers. “They had videotapes of things that were being said. This has been a fight. They broke ground for us.”

Busting Chops

But the size and scope of the local organizing effort stretches far beyond Brewster and next week’s Mar. 26 vote for 65 Yorktown employees.

Union activity is developing building by building at the old CareMount, across the region, brewing in Briarcliff, Ossining, Croton, Somers, Katonah, Jefferson Valley, Carmel, Patterson, Fishkill, Poughkeepsie, Kingston and beyond.

Efforts are even underway in Mount Kisco, where the organization maintains several buildings and got its start as Mount Kisco Medical Group in 1946.

“There’s others, too,” my source said of the New York area labor effort, with local leaders at the various former CareMount buildings. “It goes from New York City up to Kingston.”

When I initially interviewed the source earlier this month, they said representatives from the Minnesota-headquartered insurance/healthcare/data analytics multinational conglomerate were roaming the offices, trying to put the kibosh on the effort.

“They’re walking around with Optum IDs on, but there’s no picture and there’s no title,” the source said. “There’s just a first name. So we know those are the lawyers for UnitedHealth Group, and they’re going to be holding meetings and trying to dissuade us and all this other garbage for the next two weeks. And we’ve all already said none of us are attending the meeting.”

(Optum’s press office stopped replying to my requests for comment last year.)

“Our three medical groups have the expertise, experience and dedication to create exceptional, personalized experiences for our patients, their families and our communities,” states a portion of a prepared comment the company issued to us in 2022.

‘They Will Haunt Me’

As followers of this series know, I’ve also been receiving documents on about a monthly basis since last summer from state Attorney General Letitia Ann James’ office, resulting from a FOIL request I submitted last January.

The latest batch of digital documents, obtained earlier this month, includes many more stories of patients citing systemic efforts to get them to pay errant bills, and details efforts by the AG’s Health Care Bureau to aid complainants.

For instance, one CareMount patient on July 24, 2022, contacted the AG’s office alleging persistent harassment despite providing Medicaid documentation.

“They simply do not acknowledge my calls or documentation,” the patient wrote the AG. “I am now facing [an] endoscopic biopsy and colonoscopy July 26 and can only wonder how they will ‘haunt’ me with huge copays for said procedures.”

Assistant Attorney General Abisola Fatade, in a form e-mail, told me the office would be producing another round of records by May 6. (The latest 97 pages of documents are available on our website, like past records obtained through FOIL.)

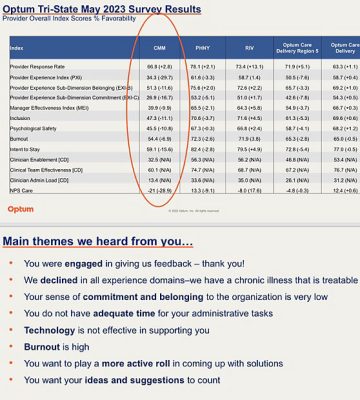

In terms of the bigger picture, these investigative columns, which debuted in December 2022, have uncovered our local healthcare company’s oppressive physician employment contract; a disastrous phone system; a related local emergency room crunch; alleged double billing; copay confusion; a scathing internal survey; data privacy breaches; attorney general scrutiny; suspect COVID-19 testing charges; predatory marketing tactics; Medicare Advantage-related profiteering concerns; state lobbying efforts; a disconcerting doctor shortage; the troubling mix of healthcare with insurance services; bruising layoffs; the unethical banning of unwell patients; and the denial of patient medical records.

Optum’s policies have also left local residents largely reliant on urgent care, unable to see their primary care doctors when they get sick, with area facilities essentially no longer keeping spots open for same-day calls, the investigation has found.

Lights Out

When I visited the second-floor local executive offices last Thursday afternoon in Chappaqua, the lights were off and the doors locked shut.

High-profile departures and firings have left the area C-suite at Chappaqua Crossing largely vacant, with an estimated two dozen or so executives who worked at the former CareMount as of last year now gone following a wave of new job cuts executed last month.

We reported in January on Optum Tri-State CEO Kevin Conroy’s departure, which unfolded shortly after former president Dr. Scott Hayworth exited the enterprise, along with other recent high-profile goodbyes.

Late last year, our coverage also unveiled the outsourcing of pre-certification work to an Indian firm, IKS Health.

Sources have since noted that Hayworth is affiliated with IKS; an online search shows he chairs the advisory board for the firm. A company website lists several offices in India, along with locations in Dallas and Los Angeles.

An insider also told me Optum purchased CareMount for about $2 billion in 2022, and that Hayworth collected a roughly $90 million cut himself.

Many CareMount doctors (who had been company shareholders before Optum’s acquisition converted physicians into subordinate employees) also secured significant paydays and retired at the time.

Federal Eyes

As word began to spread in recent weeks about additional layoffs, and more doctor departures, my inbox has overflowed with patients desperately seeking answers.

“Rumor has it more PC’s have left – we are being left completely helpless,” one patient wrote me last week.

Meanwhile, on Mar. 5, the Federal Trade Commission (FTC) put out a press release announcing a joint inquiry with the DOJ and HHS into the impact of corporate greed in healthcare, particularly focusing on the influence of private equity and potential harm to patients, workers and affordability.

Amidst United’s incomprehensible $22.4 billion in profits and a $450 billion market cap (richer than the entire nation of Denmark and its $431 billion GDP), the corporation’s unchecked vertical integration has birthed anti-competitive practices, monopolizing the market from insurance to pharmaceuticals to healthcare; a mind-bending estimate of 10 percent of U.S. doctors reportedly work under the company’s thick thumb.

Patient care has taken an unambiguous backseat to shareholder wealth, and regulators currently appear poised to try and confront the threat.

While government intervention comes with its own set of credible concerns, experts generally agree that the status quo is a sick mess.

“Preserving competition in health care markets is a priority for the Department of Justice because of its important impact on the health and well-being of Americans,” Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division stated in a press release two weeks ago.

Non-Optum local doctors I’ve spoken to on the broader issues also bemoan insurance carriers’ bad faith negotiating, discrimination in pay and market control of the big operators, squeezing out independents.

“Guys like me can’t survive when I get paid 30 to 40 percent less for some services,” one independent area doctor texted me.

Deep End

It’s worth noting that I also hear from patients who remain deeply (and rightfully) appreciative to live in a community with a multispecialty medical facility within a short ride of their homes, given the remarkable physicians and other world-class healthcare workers toiling away inside of Optum.

But everyone I’ve communicated with over the past 15 months – hundreds of patients – expresses deep dissatisfaction about the severe service and access issues.

On a deeper level, this ongoing series is about what healthcare should look like.

It’s about what we should expect and demand.

In the more natural state of the world, delivering compassionate care might conjure idyllic images of a local village elder traveling the town, tending to the ill and imparting wisdom to the healthy, guiding us on foods to eat, treatments to consider, lifestyles to embrace.

The question is how to balance that ideal with modern medicine’s miracles and complexities.

Every degree of departure from that fundamental vision strips us further away from the type of nurturing, individualized, thoughtful care we crave. And no, not all corporations are precisely the same, even though the problems run throughout the entire healthcare system.

It’s not naive to point out that organizations can be hard-headed about finances while thoughtfully executing a lofty mission.

But it’s almost impossible to expect when our medical care is treated by bean counters as just another for-profit business service.

Time and Again

The cold, icy role that bad corporate sick care actors play in the modern world is tragically far removed from any sense of even trying to deliver holistic healthcare.

The miracles of modern medicine and contemporary life might necessitate different organizing structures than the past.

But the current organizing structures are putrid, and don’t serve patients or doctors nearly as well as they should.

(Just last week, The New York Times published a significant video report about the big business of denying medical care through profit-driven insurance practices like prior authorization and how insurance companies can wield power over doctors’ decisions, sometimes with fatal consequences.)

It’s both true that UnitedHealth displays particularly bad intentions and that UnitedHealth is a symptom, not a cause, of a larger U.S. healthcare disease – a byproduct of a sick, greedy system that almost everyone knows serves no average person’s best interest, whether they’re ideologically left, right or center.

And don’t forget, this isn’t about harkening back to ancient times. We used to be able to see our doctors, and generally hold their sustained attention.

Dr. John Costa, a retired local MKMG pediatrician/former solo practitioner who contacted me earlier this year with his concerns about healthcare, stressed that what’s been largely lost over only the past 25 years has been “the art of medicine.”

What is now missing?

“The ability of the physician to spend whatever time was needed with the patient to answer their questions and address their concerns,” Costa wrote in an op-ed he prepared for The Examiner, attributing the broader healthcare problems to the influence of Managed Care Organizations (MCOs) and corporate interests.

When was your last appointment with enough time for the doctor to ask about your diet and sleep patterns with space to truly listen to you, instead of hastily scribbling a prescription?

Knockin’ on Optum’s Door

Lastly, a quick note to reference the fact that several sources told me about internal efforts to suss out and identify the insiders who have been leaking all of this reporting detail to me. (There are way too many, don’t bother.)

Corporate leaders should instead direct their energy toward fixing the vexing problems that their colleagues feel compelled to share with the world, risking their careers to come forward.

And if the existence of tapes makes executives nervous, well, good, we’d all be well-served if they wondered whether we’re listening as they plan the future of our care.

In the coming months, I’ll be preparing deep-dive columns on local alternatives, trying to offer frustrated patients an opportunity to explore their healthcare options.

We’ve been banging on these locked doors for too long, feeling trapped by limited choice.

But it’s past time for many patients to knock on new doors.

There’s real reason for long-term optimism if we demand reform.

Much more to come.

Adam Stone is publisher of Examiner Media. E-mail him with tips and feedback at astone@theexaminernews.com.

Adam has worked in the local news industry for the past two decades in Westchester County and the broader Hudson Valley. Read more from Adam’s author bio here.