Documents: Attorney General’s Office Derides CareMount/Optum’s ‘Hot Mess Billing’

Opinion Advocates for ideas and draws conclusions based on the author/producer’s interpretation of facts and data.

Heath Care Bureau Assistant AG Appears to Elevate Probe

Patient Stories Expose More Systemic Issues at Healthcare Group

Doctor Shortage Imperils Sick Woman, Forcing Hospitalization

This is the eighth installment in an investigative series about CareMount/Optum, broader local healthcare issues and corporate medicine.

By Adam Stone

I’ve written a lot this year about the systemic failings at CareMount/Optum, and the implications for local patients.

In fact, this week, I’ve gathered new reporting that suggests a possible escalation of the state Attorney General’s Office’s scrutiny of the corporate healthcare operator, with legal staff deriding the group’s “HOT MESS billing” in internal correspondence. (Caps are their emphasis, not mine.)

But before we get to all that, let’s start on the human level and consider the cost of CareMount/Optum’s severe and dangerous shortcomings through the eyes of Victoria Hunt.

The Poughkeepsie resident’s experience with the lumbering local healthcare giant offers an especially relevant glimpse at the type of blockades to care and support that countless area people confront on a daily basis.

Although Hunt’s headaches in dealing with the sprawling medical group were through offices up in Dutchess County, what she endured encapsulates the challenges residents in Westchester, Putnam and across the country face when trying to secure quality treatment in our corporate healthcare system.

About four months ago, Hunt, who suffers from Lupus, started feeling unwell and all she wanted to do was visit her doctor.

Symptoms Emerge

Hunt must see her physician every three to six months because of the need to carefully monitor her condition.

She repeatedly called her local CareMount/Optum office, about six or seven times over a period of several months.

“They couldn’t give me a doctor,” the 64-year-old retired corrections officer told me in an interview last week. “Nobody could give me a doctor’s appointment. And when you call, sometimes people are hanging up on you. What’s going on over there?”

She eventually secured a date but not until Nov. 27.

Then, about three weeks ago, Hunt’s health began to deteriorate. She was suffering from dizziness, vomiting and excessive sweating.

“It felt like somebody took a bucket and just drenched me,” Hunt said. “And I’m calling and calling because I have lupus. So when stuff like this happens, I need to see the doctor.”

Uh, yeah.

Health Peril

Still unable to secure an appointment with her physician, Hunt summoned an ambulance on the evening of Sept. 30, and was admitted in the wee hours of Oct. 1 for what proved to be an unsettling four-day hospital stay at Vassar Brothers in Poughkeepsie.

While at Vassar, additional health complications were revealed, including issues with her kidneys and blood sugar levels.

“All this time, I did not have an appointment, so I got sick and I called the emergency services and they came and got me from my house, and I was in the hospital,” explained Hunt, who was ultimately released on Oct. 4. “With lupus, it dries me out, so I have to get fluids put in my body, and all of that, and my sugar dropped down.”

I asked the very obvious question: If it wasn’t for the understaffing of doctors at the stupendously profitable CareMount/Optum and she had been able to secure an appointment this past summer, or even earlier this fall, how might the situation have unfolded differently?

“If they would have gave me an appointment with my doctor, then they could have seen what was going on,” Hunt replied. “If they would have given me an appointment with a lupus doctor, they would have seen that my lupus was off the charts, and they would have either put me in the hospital or given me something to take at home. But they wouldn’t give me an appointment. No way. No how.”

One evening while in the hospital, the health scare turned especially grim.

“And the metformin they was giving me, it messed up my kidneys, so they had to take me off the metformin,” she said. “One night, I almost went into a coma because my sugar was so low, and they had to give me juice and stuff. Finally, I started getting better.”

Hunt was lucky to make it out alive.

Canceled Appointments

In addition to the difficulties she’s experienced trying to see her doctors, Hunt also described having appointments mysteriously canceled by CareMount/Optum without notification.

Last January, after her lupus specialist announced she was leaving the practice, Hunt tried to schedule an appointment with another provider. Her initial expectation was to see the doctor in July, in line with her usual three- to six-month lupus checkup routine.

However, this arrangement unraveled when she called CareMount/Optum to confirm the date. To her shock, she was informed that her appointment was rescheduled for December 2024.

That’s right. Not the December that is two months from now. They reassigned her, without her knowledge, to December of next year!

“That wasn’t the appointment they gave me,” Hunt explained. “They changed it and didn’t even notify me that it was changed. Nothing. And if I would not have called, they wouldn’t have ever told me. They didn’t have the decency to call me and tell me nothing.”

But it’s not just the healthcare service issues that have been so vexing for Hunt. Like countless others, Hunt railed against the company’s byzantine and deeply troubled billing system.

“I used to get bills, and I would pay, and I was still getting bills, and I’m like, ‘This is crazy,’” she said.

Fraud Allegation

An especially problematic and perplexing snafu surfaced in 2021.

As Hunt explains it, CareMount incorrectly billed UnitedHealth Group instead of worker’s compensation for a February 2021 follow-up surgery on her right knee, a procedure necessitated from a work injury.

“Don’t you know those people at CareMount, they billed UnitedHealth,” she fumed.

Hunt said the billing discrepancy resulted in threats of legal action against her for fraud. Because of CareMount’s error, she said a May 2021 letter from United accused her of fraudulently trying to have the insurance giant pay for a surgery that was supposed to be covered by worker’s compensation.

“So,” Hunt added, “when I received the letter from UnitedHealth saying they were going to sue me and I’m committing fraud for the surgery on my knee, I was like, ‘What?’”

‘Crappy’ Billing

She had been calling time and again, pleading for CareMount to address the blunder. Even if the whopper of a mistake was more than likely unintentional in nature, it was the apathy, unresponsiveness and miscues on CareMount/Optum’s part in the aftermath of the error that incensed Hunt.

“I was calling like twice, three times a week,” she said. “Let me tell you, after a while they wouldn’t even pick up the phone because I guess they don’t want to hear it.”

At one point in the process, she connected with a CareMount/Optum staffer who promised the situation had been resolved.

“She’s saying on the phone, ‘Oh, yeah, it’s all taken care of. We got it all taken care of.’ She lied. She straight lied.”

Hunt eventually connected with a helpful representative at United.

“The young lady I was speaking to, she used to be a CareMount patient, and she said, ‘Their billing is crappy,’” Hunt recalled.

She recounted how the issue got resolved in June 2021, when a CareMount representative rectified the situation by contacting United, making it clear that Hunt’s surgery should have been billed to worker’s compensation.

CareMount then tried a little damage control, with a manager reaching out to Hunt, seemingly concerned about how she might handle the outfit’s massive fumble.

“But when I needed help, nobody wanted to help me,” she said. “Now you want to call me and talk about, ‘Oh, you so sorry.’ It shouldn’t have ever happened.”

As for bigger picture U.S. healthcare concerns, Hunt noted how there are problems with corporate medicine across the country, but she also believes there are especially acute issues at CareMount/Optum.

“No matter where you go, I think it has to do with what happened with COVID,” she said. “A lot of doctors are retiring; a lot of doctors are leaving their practice. But come on, let me tell you, they’re funny.”

Context

UnitedHealth Group, the biggest insurance corporation on the planet, is actually Optum’s parent company.

CareMount (previously called MKMG and Mount Kisco Medical Group before that) was the organization’s most recent former business name in the group’s merry-go-round cycle of periodic rebranding over the past decade.

Optum Tri-State, the division in our region, was established in 2022 by merging the local CareMount Medical with Riverside Medical Group and ProHealth Care.

United, for its part, reported a gross profit of an unseemly $89 billion for the 12-month period ending last month, marking a year-over-year increase of 17.71 percent.

Optum’s full-year revenue in 2022 eclipsed $182 billion, up 17 percent over 2021, with the Optum Health division fueling a considerable portion of the company’s growth.

God bless ‘em, I suppose. But while raking in tens of billions of dollars on our collective health, can they at least hire a few more doctors to see sick patients?

And how about investing in some receptionists to answer the phones for patients uncomfortable with digital portals?

Can the company at least take these steps?

The answer appears to be an emphatic no, as layoffs were reported at Optum in August.

Filing a Complaint

Fed up with all the frustration in trying to make an appointment, and two days before her Sept. 30 medical emergency, Hunt filed a complaint with the state Attorney General’s Office, outlining her experiences.

She explained how her primary doctor was relocated, and her lupus specialist left the group.

“This medical practice refused to help patients secure appointments for other doctors,” Hunt wrote in a portion of a detailed complaint, which she shared with me. “Then when you would call to get an appointment for another doctor in the practice…they would cancel and not tell you.”

The AG’s office, by Oct. 5, replied to Hunt by e-mail, stressing how “every complaint to this office is carefully considered.”

“Please be assured that we will thoroughly evaluate each of the issues you have raised, and determine if we, or any bureau within our office, can provide assistance,” the attorney general’s Health Care Bureau assured Hunt in the e-mail she showed me last week.

Hunt also plans to file a complaint with the state Health Department.

Stone’s Throw Investigation

For any of you coming into this series for the first time today, we’ll do a quick review about some of what this ongoing investigation has uncovered and reported over the past 10 or so months.

A quick bulleted list:

- Questionable COVID-19 billing discrepancies have drawn scrutiny by the state attorney general’s office.

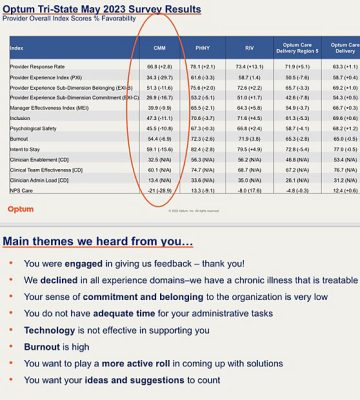

- A leaked internal survey revealed deep doctor discontent with management, and the medical group acknowledged its “chronic illness.”

- A restrictive employment contract traps disgruntled doctors inside the corporate vortex, even when they’re desperate to leave.

- An emergency room crunch at Northern Westchester Hospital ensued as a result of appointment availability issues at CareMount/Optum.

- CareMount’s lobbying of the state on Medicare-related issued unnerves local seniors fearful about privatization efforts.

- A local stillbirth mother was initially denied medical records, and ultimately terminated from receiving care in unethical fashion, along with her husband, risking their health.

- A maddening phone system frustrates the ability of patients to see and easily communicate with their clinicians and other organization representatives.

Information Wants to be Free

Meanwhile, earlier this month, I received a new batch of public records from the Attorney General’s Office.

Back in January, I had filed a Freedom of Information Law (FOIL) request for documents, and the internal AG’s office correspondence about CareMount/Optum has been rolling in piecemeal in recent months.

Interestingly, while the nature of the Attorney General’s Office interest in CareMount/Optum remains uncertain, there is one particular new document in the latest reveal that further hints at the possibility of a heightened examination.

(Read the documents on our website.)

On May 2, Health Care Bureau staffer David Payne sent a letter to an assistant attorney general that seems to confirm the office’s wider concerns about the institution.

“Please be assured that we have documented your concerns, and we will keep a copy of your correspondence on file,” wrote Payne, a Heath Care Bureau “Legal Assistant II,” a type of office paralegal.

His e-mail was addressed to Adrienne Lawston, an assistant attorney general helpline manager in the bureau. Lawston had formally alerted the legal assistant about her concerns and shared relevant records.

Generally speaking, a legal assistant’s services might be enlisted for such tasks as legal review, investigation, documentation, research and analysis, all aimed at supporting possible action by the office.

One curious element of Payne’s letter, for me anyway, is that he says how the concerns he’s received from Lawston are about OptumRx, the company’s pharmacy division. As far as I could tell, there weren’t any other explicit clues in the other documents I obtained that addressed OptumRx specifically.

That said, I’m expecting another batch of documents by Nov. 6.

“We intend to continue producing records to you on a rolling basis until we have provided all additional, responsive and non-exempt records and issued our final determination of your FOIL request,” AG FOIL Officer Abisola Fatade wrote to me in an Oct. 5 form e-mail.

‘HOT MESS’

When thumbing through the latest round of digital documents, my jaw dropped when I saw staff at the AG’s office refer to CareMount/Optum’s billing practices in the type of colorful and disgusted language many local people have deployed when posting to social media.

A February e-mail exchange over two days between Lawston, the assistant attorney general helpline manager in the Health Care Bureau, and one of the office’s helpline advocates, Erin Signer, was labeled with an alarming but seemingly spot-on subject line: “Caremount HOT MESS billing.”

Signer informs Lawston how a patient who brought a complaint had been grappling with billing issues for years but “only just decided to bring it to us.”

“The patient makes payment and they break up the payment and apply portions of the payment to random dates of service,” Signer explained to Lawston in a Feb. 16 e-mail about the medical group’s famously wretched billing system. “Often, only partially paying the services.”

The interoffice correspondence transpired amidst Singer’s inability to retrieve clear answers from CareMount’s local Chappaqua administrative office.

For instance, the day prior, on Feb. 15, Signer asked the group’s patient account manager to break down how patient payments were applied to dates of service, expressing concerns about the lack of consideration for the chronological order of balances and small partial payments.

“This,” Signer told CareMount, “makes personal accounting near impossible as the check amounts are not reflected on the bill.”

The bottom line is that the organization’s billing process, whether due to benign neglect or something worse, results in patient payments being applied erratically to different dates, often leaving services only partially paid.

This causes considerable confusion for patients who struggle to reconcile their payments with the bills they receive.

‘VERY Confusing’

When communicating with CareMount and seeking answers, on Feb. 15, Signer was very clear with the patient account manager.

“It does not appear the patient payments are being applied to the oldest balances first and, instead, appears that small partial payments are spread out across various dates of service, with no regard to the date order,” she told the CareMount representative.

In a string of internal communication with Lawston on Feb. 15, Signer also expressed frustration over the lack of clarification from CareMount regarding the application of payments by the group’s billing system, particularly for a look-back period extending to 2021.

“I asked for an explanation of how their system applies payments and they have not been able to answer,” Signer told Lawston, her supervisor. “Once I get the breakdown of how they applied the payments we can circle back so I can show you what I’m talking about. It’s VERY confusing.”

The next day, on Feb. 16, Signer shares her lingering aggravation, noting how she’ll push only once more for a clear reply.

“I’ve asked several times,” Signer told her superior, “and they do not have an answer. I will ask once more, which will make three times.”

Poker Face

There’s also a potentially interesting “tell” in the documents, if we’re reading the tea leaves over whether the AG’s office may be engaging in a more serious investigation, beyond just reviewing and assisting constituents with civil complaints.

In the 60 pages of documents from my most recent FOIL haul, which address a variety of cases, the only e-mails that are entirely blacked out are a select few of Lawston’s replies to Signer’s exacerbated messages, such as when answering the all-caps e-mail about the “VERY” confusing system.

Are those messages from the Health Care Bureau assistant attorney general only blacked out to keep personal patient information private? That does not appear to be the case.

In other redacted passages throughout the 60 pages, it’s clear from the context where patient names are blacked out, and then the rest of the text is available.

The obscured messages could be internal talk about possible escalation of the case.

On Feb. 16, the day after her all-caps irritation, Signer wrote Lawston again, relaying her various efforts to seek clear answers from CareMount, with the healthcare operator just replying with apparent obfuscation and gibberish.

“They haven’t addressed it at all,” Signer laments in a portion of her Feb. 16 message to Lawston.

You guessed it: Lawston’s subsequent reply to Signer is then again blacked out.

‘No Rhyme or Reason’

Earlier in the exchange, on Feb. 15, Signer had expressed annoyance with CareMount’s handling of patient payments and their inability to explain discrepancies, highlighting the challenge of tracking payments.

“(I) believe I (told) you about this provider before,” she had reminded Lawston about CareMount.

In other words, Signer appears to be highlighting for the Health Care Bureau assistant attorney general how the organization is a repeat offender, hinting at the possibility of problems at an institutional level.

Signer alerts Lawston about how the complainant had endured a lengthy call with CareMount to address payment discrepancies. The patient provided additional proof of payment, yet still encountered issues in matching payments to billing statements.

“When you review the billing statements from the period they would be reflected on, there is no patient payment that matches,” Signer tells Lawston on Feb. 15. “CareMount has no rhyme or reason for how they disperse patient payments and it makes it impossible to keep track of what is paid and what isn’t.”

She then provides a simplified example to illustrate the issue for her boss.

“They’re not able to answer why if I get a bill for $500 and I pay $500, that payment gets put toward old balances which were not reflected on the statement I paid,” Signer stated to Lawston in the Feb. 15 e-mail.

More Gobbledygook

The problematic replies from CareMount to Signer actually started earlier in the process.

On Feb. 9, Signer had pointed out to CareMount and Optum representatives how the patient in question “provided proof of two payments which were not accounted for in the summary you provided previously.”

Yet she kept getting stiff-armed with nonsense.

If you want to join Signer in the impossible effort to decode opaque, tortured explanations to straightforward questions, let me share a portion of one of CareMount’s impenetrable replies, such as a letter from Feb. 13, two days before Signer and Lawston’s “HOT MESS” internal correspondence began.

Signer had asked CareMount how the system applies payments but no explanation was provided in the organization’s reply.

“The two payments in question were made prior to the 18-month look back period and were not included on the spreadsheet,” the CareMount representative wrote in a portion of her Feb. 13 message. “Upon receipt of your follow-up email, I confirmed that we received and posted the payments.”

Huh?

You have to wonder why CareMount would be motivated to avoid clear answers to clear questions.

When Signer shared the latest dodge to Lawston, on Feb. 16, she appears to seek out next steps from her boss, as if the office has perhaps hit a dead end by relying on CareMount for credible cooperation.

“I’m happy to take feedback on this and see if we can at least get a meaningful answer as they haven’t addressed it at all,” Signer said.

Lawston’s answer to Signer, again, is blacked out.

Case After Case

In the latest collection of documents, there’s a separate case from January 2022 involving a patient at CareMount who received a respiratory culture.

Due to a billing error, a venipuncture charge was wrongly applied, which the patient disputed.

“The NY Attorney General’s Health Care Bureau received the attached request from mother of the patient, regarding a venipuncture charge which, she states, her daughter never received,” a letter from Signer to CareMount stated. “They had discussed potential future labs if needed, but she disputes any labs were taken on January 4, 2022.”

CareMount later confirmed that the venipuncture was not performed, voided the charge and apologized for the billing error.

But it seems safe to say that the patient tried hard to get the matter resolved with CareMount directly, before having to fuss and waste time seeking aid from the state Attorney General’s Office.

In fact, in yet another case, a patient underwent a mammogram and made a payment of $734 on Apr. 30, 2022. But due to an incorrect discount application and a posting error, an additional $33 was billed, leaving an incorrect balance of $33 on July 6.

The patient had initially tried to address the matter directly with CareMount before seeking assistance from the Attorney General’s Office.

Armchair Hypothesizing

Separately, another patient was billed for a July 29, 2021, COVID-19 test, leading to a dispute with Medicare.

For some reason, CareMount/Optum billed the patient for having a stuffy nose.

“The physician used the medical diagnosis of nasal congestion as the primary diagnosis on the claim for (the appointment) on July 29, 2021,” CareMount acknowledged to the AG’s office in a June 24, 2022 letter.

What might a suspicious investigator hypothesize with all of these unpleasant patient experiences in mind?

It’s fair to wonder whether the documents and anecdotal accounts suggest several potential areas of inquiry for the AG’s office, including over-billing, inadequate record keeping, lack of transparency, unresponsiveness in customer service and potential disregard for regulatory compliance.

By way of example, on the regulatory front, the federal “No Surprises Act,” enacted at the end of 2020, added safeguards for consumers from unexpected medical bills and enhanced transparency in healthcare costs while also introducing mechanisms for dispute resolution.

Whether the issues at CareMount/Optum ultimately result in accountability remains deeply uncertain, to say the least, but potential consequences for a healthcare operator in a situation like this, generically speaking, could encompass fines, compliance oversight and restitution for impacted patients.

Backdrop

On another interesting and perhaps relevant note, as I highlighted in last month’s installment of this series, Lawston played a helpful role in James obtaining refunds for New Yorkers wrongfully charged by an outfit called CareCube for COVID-19 tests.

The crackdown was part of James’ broader effort against misleading medical billing practices.

To put this context another way, Optum would be a potentially enticing big catch for an ambitious and aggressive attorney general with a track record for fishing in the sometimes slimy waters of New York healthcare.

The documents I reported on last month showed how the medical group’s billing practices related to COVID-19 testing appear to be under significant scrutiny by the attorney general’s civil office for possible irregularities.

Let’s just place all of this background, for now, in the “things that make you go hmm” department.

For what it’s worth, and to put informed speculation into relevant perspective, James has been proactive in investigating the healthcare sector.

Aggressive AG

When James captured $50 million from drug manufacturer Endo Health Solutions in September in an opioid-related case, she credited Payne, the legal assistant, among many others, in a press release.

Last week, the office also announced how it secured $350,000 from Personal Touch for a data breach compromising more than 300,000 people and their personal and medical data, along with an additional $100,000 from an insurance software vendor.

And last month, the AG reached a $3.3 million settlement with a Dr. Klaus Peter Rentrop and Gramercy Cardiac for an illegal kickback scheme involving referrals to their cardiac diagnostic group. Recovered funds were returned to Medicaid.

I’d love to hear from the horse’s mouth directly on all this, but an Attorney General’s Office press secretary, Halimah Elmariaha, did not reply to voice, e-mail and text messages seeking comment last week.

As for CareMount/Optum, the conglomerate’s media relations representatives suspended communication with us earlier this year (without any grand announcement, to be clear).

But in February, local Optum Tri-State CEO Kevin Conroy, in a letter to the community, addressed the widening chorus of concerns broadcast both on social media by local residents and reported in our coverage.

At the time, he cited a commitment to add more physicians and clinicians, expand the call center, extend hours and appointment availability and form a patient advisory council, amid growing anger about the healthcare group’s performance.

“We understand the frustrations, particularly with respect to connecting with us by phone, booking an appointment online, and gaining access to your medical information through our patient portal,” Conroy stated in the Feb. 20 letter.

Make of it what you will, but no one from any side of this saga has pushed back on a word of my reporting so far, and here we are in part eight of an ongoing series.

‘Screw It’

It’s also worth noting how I connected with several other local patients in recent weeks with similar concerns.

One woman reached out to me to share a personal experience of being billed for a visit that should have been covered by Medicare.

Despite attempts to resolve the issue, Optum’s failure to respond to Medicare’s request ultimately led to the denial of her appeal.

“I decided to just say screw it and pay the bill, it wasn’t big and thankfully I could say bye-bye to Optum since I’ve moved, still holding onto just one longtime provider,” said the woman, whose husband still has doctors at the group, and requested anonymity, fearing reprisal. “But I’m pretty sure Optum banks on people giving up like this.”

You have to wonder how many millions upon millions the company generates from busy and overwhelmed patients understandably reluctant to deal with the hassle of enlisting the state Attorney General’s Office to fight small but baseless overcharges (not to mention undetected overcharges).

‘Inhuman Machine’

Also, a local couple contacted me about a billing issue they encountered with CareMount/Optum recently related to a second appointment they had to make due to a doctor’s prescription mistake.

Despite their attempts to resolve it, they faced unhelpful responses and were charged about $70 for someone else’s error.

Although it was a modest sum, “they were wrong to bill us,” the husband stated last month, also requesting anonymity.

They pushed and pushed to get it resolved and were finally successful.

“(But) now we are faced with two additional billing errors,” the husband said in a follow-up e-mail last Friday. “We were sent a bill from Optum for something we had already paid. In addition, we were charged for a copay at a visit that did not require a copay. We are currently working to resolve these issues.”

Meanwhile, Mount Kisco’s Nancy Abramson, a patient for three decades dating back to the Mount Kisco Medical Group days, detailed how she received incorrect GPS directions to her Sept. 22 appointment in Yorktown.

She then encountered a rigid policy that didn’t accommodate her delay.

Abramson, who also vented about the experience publicly on social media, remains infuriated with the bureaucratic approach.

“I was met with indifference to me as a patient and a person in pain,” Abramson told me in an e-mail. “Optum has become an inhuman machine. I felt like I was at the DMV, waiting in an endless line, only to be told you have the wrong form, leaving you in a state of frustration and tears. This experience was so cold, corporate, and bureaucratic.”

Last Licks

Optum Care alone employs 60,000 doctors across 2,000 locations nationwide, boasting an astronomical 20-plus million U.S. patients.

One of the most unnerving aspects for patients about their relationships with corporate providers is the disconcerting dilemma of distinguishing between medical advice and marketing tactics.

It sometimes feels like they’re receiving Amazon-style e-mail marketing for a holiday sale, not medical information.

(Actually, Amazon itself owns One Medical, which is opening new locations across the U.S. after the tech giant’s $3.9 billion acquisition in February.)

On Oct. 16, Optum inundated patients with a mass e-mail, saying to some, in part: “You have open lab work due. An appointment is not required. Examples of lab work include blood draw, specimen collection, EKG, and pre-surgical testing including COVID testing.”

An area patient on the Nextdoor social media platform expressed concern about the note last week, troubled by the vague and seemingly indiscriminate alert, which led to anxiety and confusion, raising suspicions of a potential revenue-driven agenda.

“Optum is sending all patients this email (without any details) to get people in for bloodwork to screen for Hepatitis C,” the woman wrote on Nextdoor after speaking with a CareMount/Optum representative. “…Seems like an insurance money grab to me.”

The list just goes on and on and on, resulting from gross incompetence, understaffing and potentially worse.

When I return to the topic next, probably in November, I’ll be asking local elected officials what, if anything, they plan to do to assist constituents with their intensifying concerns.

There’s more to this story. We don’t know exactly what that means just yet, despite some significant clues.

But it appears as if at least portions of the mystery can be solved in due time.

Keep it here.

E-mail me at astone@theexaminernews.com with tips and feedback.

Adam has worked in the local news industry for the past two decades in Westchester County and the broader Hudson Valley. Read more from Adam’s author bio here.