Patient Anxiety Deepens as Turmoil Escalates Inside CareMount/Optum

Opinion Advocates for ideas and draws conclusions based on the author/producer’s interpretation of facts and data.

This is the 12th installment in an ongoing investigative series, launched in December 2022 about CareMount/Optum, broader local healthcare issues and corporate medicine.

By Adam Stone

One result of launching an ongoing series about the problems at CareMount/Optum, and the inability of patients to communicate with the healthcare provider, is that people start to reach out with their issues, unsure where else to turn.

Local residents sometimes can’t quite stomach the notion of initiating the maddening process of phoning the group with even simple questions, knowing it will likely be a long and arduous process.

One such patient contacted me on Jan. 15, noting how she’d “been dealing with the frustrations of the CareMount/Optum medical group for a while.”

“To add to that, last fall I received notification that my primary care physician was leaving the practice at the end of the year,” wrote the patient, who requested anonymity, fearing reprisal. “That was frustrating and disheartening given my appointment in spring of 2023 was canceled two weeks prior due to ‘scheduling issues’ after being scheduled for over a year, and now my appointment for March of 2024 was suggested to be rescheduled with a new PCP who had no openings in all of 2024.”

Then the patient got to the meat of the issue.

She’s visited local Optum urgent care four times over the past four months, using both the Yorktown and Mount Kisco locations.

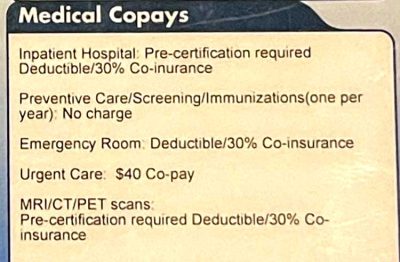

Each time, she was billed $60 and paid upfront right away. But she recently noticed that her insurance benefits (which are administered by Daniel H. Cook Associates via Cigna’s provider network on behalf of the plan sponsor, the International Brotherhood of Trade Unions, Local 713) designate a standard copay of $40 for such visits.

Doesn’t Add Up

Last Thursday, after our initial phone interview, the patient contacted the phone number on the back of her insurance card to investigate the matter.

A representative told her that every time she was charged $60 by CareMount/Optum, the healthcare provider “sent it into insurance that it was a $40 copay.”

“And the estimate or the explanation of benefits shows that on record that it was a $40 copay,” the patient said in one of our phone interviews last week. “So I don’t know why I was charged a $60 copay. I don’t know where that other $20, so to speak, is floating around to.”

The patient also provided me with the relevant documentation.

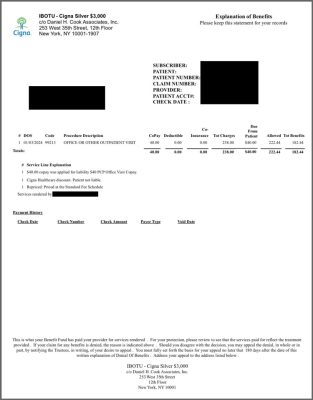

For instance, she e-mailed me the explanation of benefits paperwork from the insurer for her four outpatient urgent care visits, which featured seemingly routine tests, like blood pressure screenings.

“$40.00 copay was applied for liability $40 PCP Office Visit Copay,” the insurance benefits statement summarizes about the patient’s 2023 urgent care sessions on Aug. 10, Nov. 8 and Dec. 22, along with her Jan. 3 visit from earlier this month.

‘No Clue’

By last Friday, the patient finally found the time and mustered the fortitude to call CareMount/Optum, to seek a reasonable explanation.

She reached out to the medical group three times throughout the day on work breaks.

But guess what? Each time she was transferred to leave a message.

She quit her phone call efforts by the end of the day.

While the source acknowledged the possibility of human error, or a misunderstanding about the nature of the benefits, she believes an innocent explanation remains highly unlikely given what the representative confirmed for her last Thursday.

“If it’s just like someone put my information in the computer wrong, why is it showing on the other end of it when they’re submitting it to insurance with the correct copay?” she pointed out. “Why when I go to the desk and check in and say, ‘Hey, I’m here,’ they say, ‘Give me $60.’ But when they submit it to insurance, it’s correct.”

In fact, she asked the insurance benefits representative what could theoretically cause a $60 charge by CareMount/Optum followed by CareMount/Optum submitting a copay to insurance at $40 without CareMount/Optum then refunding the patient the surplus $20.

“And she said she had no clue,” the patient told me of her conversation with the representative.

Fish Fry

As with many patients who are busy leading their lives, how much time to spend fighting on principle can become a tough call.

But this particular patient, who struck me as even-keeled and level-headed, said her need to use urgent care for ongoing health issues might make the matter worthy of her attention, noting how she’s dealing with “enough medical stuff that if it saves me money, then it’s worth it in the long run.”

“And,” she added, “if other people are having the same issue, for sure it’s worth pushing. But I also have bigger fish to fry medically and working full-time.”

I also asked if she believes she’s stumbled upon a major transgression.

“I feel like there is something that potentially is significant here,” she replied. “And the fact that it’s showing on the back end as $40 and they’re charging me the $60 just doesn’t sit right with me.”

‘Part I Can’t Get Past’

I reached out to Cigna’s media relations team last week to discuss the issue. The anonymous patient source granted me permission to share her name and birthday with the press representatives, so they could research case details.

A Cigna spokesperson, Kelly Matthews, ultimately said the company couldn’t comment on the specifics of the case. Yet Matthews did note how “some health plans apply a primary care provider or specialist copay depending on the services or tests rendered during a visit.”

But when I brought that explanation to the patient, she said it didn’t add up.

“If that same copay amount reflected on the explanation of benefits, then I could see that being the reason behind this, but I can’t see that being the justification when the two items don’t match,” the patient told me, after I shared the press office’s perspective. “At least that’s the part I can’t get past.”

I took that pushback to the Cigna press team. Matthews then referenced the fact that the patient had likely spoken to a third-party benefits representative, not a Cigna employee, when she called the number on the back of her insurance card.

While that is accurate, I pointed out how the third-party representative knew the patient’s benefit allowance and had the patient’s account information pulled up.

So why would the representative’s status as a third-party vendor be relevant to the facts of the case?

I didn’t hear back from the press office after that. But local health insurance broker Jim Newhouse helped me understand. More on that in a minute.

Smoke

One major cost of rampant bad behavior is the squandering of goodwill and surrendering the benefit of the doubt.

Perhaps there’s a credible explanation for the circumstances surrounding the patient’s case. (Or perhaps there’s not.)

But, either way, the fact that this patient and countless others can’t even get CareMount/Optum on the phone much of the time when issues arise speaks to the larger problem.

Even the most generous interpretation of the case details fails to negate the inexcusable inability to communicate concerns with the healthcare group and obtain clear answers.

And given the widespread and longtime allegations of overbilling by the medical group, there’s every reason to at least investigate whether there’s fire at the first sign of smoke.

What’s the Dillio?

The patient’s insurance card does say she should be charged $60 for specialist visits and $40 for urgent care. Could the argument here be that the nature of the medical visits to urgent care were more specialist in nature?

But several things make that explanation seem insufficient.

First off, the reason the patient is going to urgent care is because she can’t book a standard appointment, as a result of CareMount/Optum’s access crisis. She’d received notice in the fall that her primary care physician was leaving the practice at the end of 2023.

“Since my doctor had announced [they were] leaving and how impossible it is to get in for same-day appointments, I sought treatment at urgent care,” the patient explained.

Beyond that, the representative shared documentation confirming that the urgent care visits were noted at $40 in the benefits statements.

With all that in mind, when or if she actually makes contact with CareMount/Optum, I asked the patient what she’ll say.

“I have the receipts, I have the estimation of benefits, showing the $40 copay that you submitted to them,” she replied. “What’s the deal and why? And what are you going to do?”

A message I submitted to the public affairs office for the New York State Department of Financial Services, which regulates insurance, was not returned by press time.

Expert Insight

Jim Newhouse is the owner of Newhouse Financial & Insurance Brokers, a Rye Brook-based health insurance consulting firm. He said a key part of this story involves the International Brotherhood of Trade Unions (IBOTU), Daniel H. Cook Associates, and understanding how these types of programs work.

“The reason these plans are attractive to individuals is that they offer coverage with national networks and include out-of-network coverage which is not available through the marketplace, aka ObamaCare,” Newhouse observed.

He noted how these plans, operating within the Cigna network, have faced numerous lawsuits and are not approved or regulated by the Department of Financial Services in New York and other states.

Newhouse mentioned how most people do not know about the related problems when purchasing policies.

“You’ve stumbled into something that you have the potential to be responsible for blowing up something that should have been blown up 15 years ago,” he said.

Newhouse pointed out how Cigna has absolutely nothing to do with the plan “beyond providing the network of doctors and hospitals.”

As for the $60, he said if it is just an administrative error, it should be an easy one for CareMount/Optum to fix.

“I don’t know where Optum got the idea that they should be collecting $60,” he said. “There’s nothing in the ID card that would indicate it. But the question is, where did CareMount come up with the $60 number?”

Newhouse also said he’s confronted a long list of problems with CareMount/Optum himself as a patient. He believes the organization is “just very, very frustrating to deal with and blows smoke out of both sides.”

*Insight from Newhouse was added to the piece on Jan. 29 after original publication of this article.

Local Pols

State Sen. Peter Harckham (D-South Salem) was not available for an interview on Friday but his spokesperson, Tom Staudter, noted how “constituents are always welcome to call with their issues or problems.”

“Notifying insurance companies about improper copays, or at least questionable billing, isn’t always easy,” Staudter said. “Sen. Harckham’s office stands ready to assist – or at least direct people to state resources that may help.”

Congressman Mike Lawler (R-Pearl River), for his part, said he’s exploring federal legislation to tackle related issues, such as the Doctors Within Our Borders Act and the Streamline Emergency Care Act.

The measures aim to boost the healthcare workforce and allocate extra funds to local healthcare facilities.

“I’m deeply concerned about the reports that allege overbilling and short staffing at Optum, which provides healthcare services to so many of my constituents,” Lawler stated to me through a spokesman, Nate Soule.

In an interview at his Rockland County district office in December, the congressman also told Examiner Editor-in-Chief Martin Wilbur and I that he’s been monitoring the bigger picture concerns about Optum, which is a subsidiary of UnitedHealth, the world’s largest insurance firm – a $449 billion multinational conglomerate.

“So we’ve reached out, based on some of your coverage, we’ve reached out to United to make them aware,” Lawler said at the time. “Like, ‘Are you even aware?’ So we’ve made them aware of the reporting that you had, and they said they’re looking into it and they’ll get back to us with feedback.”

**This article was updated after original Jan. 29 publication. A former CareMount/Optum worker (she worked there from 2020 to 2023) reached out to reference the fact that “the former CareMount Medical urgent care locations are not accredited as Urgent Care Centers.” She cited a page on the Optum website that says, “Your visit will be billed as an ‘office visit.’ It will not be billed as an ‘urgent care visit’ because we are not accredited as such.” The marketing and branding of the facilities as urgent care centers coupled with the lack of accreditation raises additional questions to be reviewed in future coverage. “I was always curious as to why they are not accredited,” said the former worker, noting how the lack of accreditation stretches back many years. She recalled that “informational cards were also laid out in the waiting rooms” to explain the circumstances about urgent care. The uncertainty regarding why the patient’s statement of benefits indicated $40 after she paid a $60 copay remains unresolved.)

No Drops for You

In covering the travails of CareMount/Optum over the past 13 months, I’ve also wondered whether a time might arrive where all the doctor departures and service cutbacks and outsourcing could ultimately produce a new level of operational decay.

Might the organization lose the ability to consistently execute successfully on the most basic functions? The verdict is still out, and I do hear dribs and drabs about positive encounters as well.

But some troubling anecdotal signals seem to suggest matters could get worse before they get better. Take the recent case of Chappaqua’s Robin Raines.

The longtime medical group patient had a basic chore to cross off her to-do list about a month ago. She just needed to get CareMount/Optum to refill her glaucoma eye drop prescription.

Easy peasy, right?

Not so much.

Buck Stops There

When I connected with Raines last Thursday afternoon, she and CVS representatives had already been desperately trying since Jan. 6 to get the prescription refilled.

“CVS reached out twice for refills and no one returned their requests,” Raines wrote in a portion of a Facebook post on the Chappaqua Moms 2.0 community page last Thursday, shortly before our phone interview.

She’d reached a representative at her ophthalmologist’s office just before we spoke.

“[The office manager] said, ‘Oh, who’s your doctor?’” Raines recounted for me in our telephone interview. “I told her and she said, ‘Oh, he’s on medical leave till May.’ I said, ‘When were you going to tell us?’ She said, ‘Well, it’s not our responsibility.’”

Given the mass exodus of doctors and the deep feelings of discontent among much of the staff, perhaps the administrative team just can’t keep up with the personnel developments.

“We’re not asking for something that shouldn’t be divulged,” said Raines, a New York City residential real estate broker with the Level Group who has lived in Chappaqua since 1990. “We’re asking for something that once you know that there is going to be either a change with a doctor or a separation or whatever, people need to be notified, and then they make their own choices after that.”

By the time of her conversation with the office manager last week, Raines had been trying for weeks to get the prescription filled, with phone calls but also by trying to get it done online.

I said, ‘If I go blind, a lawyer will be involved,’” Raines recounted. “I mean, I was being dramatic, but clearly I have pre-glaucoma and if I don’t take my drops, there are issues.”

Down to the Last Drop

By the end of the day Thursday, after an almost month-long effort and a very public Facebook brouhaha, Raines received her prescription refill, the day after squeezing the last drop of medicine from a now-empty bottle.

I wondered whether Raines was exploring the possibility of leaving Optum, like so many patients who like or love their doctors but dislike or detest the corporate administration.

She was initially drawn to the organization (previously called Mount Kisco Medical Group, which was founded in 1946) because the setup allowed patients to enjoy care from various specialists “under one roof.”

“And it does make life a lot easier when you have multiple specialties involved, whether it’s ophthalmology or cardiology or dermatology or whatever the specialty is,” she said.

But I asked if that advantage still trumped the growing downside.

“The bottom line is it no longer trumps it,” Raine replied. “And I think that’s why when I see on Facebook every single day people saying, ‘Give me a new doctor.’ And then they name whatever specialty it is and say, ‘Please make sure it’s not Optum.’”

Another One Bites the Dust

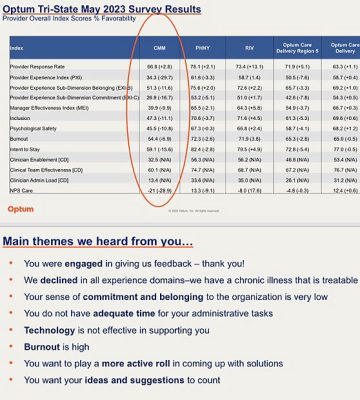

This past Saturday a CareMount/Optum physician source contacted me to share the latest news: Dr. Arbie B. Baccay, an internist, just retired, effective this week. My source is the same doctor who told me last month for an earlier piece that “primary care is falling apart at Optum.”

In his remarks to me over the weekend, the veteran, highly-respected CareMount/Optum physician said the company was unable to hire a replacement doctor or even a nurse practitioner to fill the void created by Baccay’s departure.

“Another 2,000-plus patients will have no doctor to call upon,” my physician source lamented.

The very public spectacle over the company’s apparent unraveling included additional intrigue about two weeks ago, on Jan. 19, when a source shared a company memo with me about Optum Health Tri-State CEO Kevin Conroy’s resignation.

The development followed news we broke from a month earlier about the departure of Optum Tri-State President Dr. Scott Hayworth, the longtime CareMount/MKMG chief executive who is now focused on his own company, Hayworth Ventures.

Background

For those coming into this series today for the first time, keep in mind these latest reporting details come on the heels of a litany of revelations from the past 13 months.

Although deterioration at the medical group has been discussed for decades now, the relevant line of demarcation here can be pegged as Dec. 4, 2020.

That’s the day when 264 CareMount shareholders – the healthcare group’s doctors – signed an Optum employment contract, becoming corporate employees.

This series of columns has covered or uncovered a host of issues, ranging from the oppressive non-compete physician contract, a deeply flawed phone system, the irresponsible banning of patients, internal staff discord, data privacy breaches, the troubling mix of healthcare with insurance services and an unsettling account of the patient authorization process outsourced to India, among much else.

As for alleged double billing, I should be receiving a new batch of digital documents from the state Attorney General’s Office in about a week, on Feb. 6.

In January of last year, I’d submitted a Freedom of Information Law (FOIL) request, and the resulting records have helped illustrate the sheer volume of complaints about CareMount/Optum, often about alleged “double billing” and hasty efforts by the medical group to send patients into collections.

“We intend to continue producing records to you on a rolling basis until we have provided all additional, responsive and non-exempt records and issued our final determination of your FOIL request,” records officer and Assistant Attorney General Abisola Fatade stated to me in a Dec. 6 form e-mail last year, after sharing a fifth haul of documents.

The patient complaints are being scrutinized by the AG’s Health Care Bureau, which has dubbed the company’s billing system a “hot mess” in internal correspondence.

CareMount/Optum stopped replying to my requests for comment last year while the AG’s office has only spoken through the hundreds of pages of documents it has released to us since last July.

‘Falling Apart’

As a subsidiary of the largest insurance firm on Earth, Optum’s very existence since 2011 has raised conflict of interest questions.

The healthcare division added about 20,000 doctors last year, lifting the total to approximately 90,000; almost 10 percent of U.S. physicians are now reportedly affiliated with the UnitedHealth medical behemoth.

Two months ago, Optum was slapped with an antitrust lawsuit from Emanate Health in California, which alleges anticompetitive practices, including pressuring against primary care competition and misleading patients about physicians’ departures, leading to a significant decline in hospital admissions.

The local CareMount/Optum doctor I correspond with through an intermediary recently shared how the current contract he and his colleagues are working under began on July 1, 2023, and stretches through the end of 2024.

The mood remains glum about the future.

“The place is falling apart on its own merits,” the veteran physician stated on Jan. 20.

‘Violation of HIPAA’

In November I also published a piece about a 71-year-old retired German journalist, Michael Kleff, receiving unsolicited Cologuard colon cancer test kits from Exact Sciences Laboratories, in cooperation with Optum, without his request or consent.

The Mount Kisco resident, along with his wife Nora Guthrie, had already undergone colonoscopies in Germany in 2022.

But both, to this day, are still persistently urged to take the test through an aggressive letter and phone call campaign.

The corporate nudging has rubbed Kleff the wrong way, and he recently enlisted the services of an attorney.

In a Jan. 16 letter to Optum Chief Marketing Officer Terry Clark, Kleff’s lawyer, Christopher Weddle, sought information regarding his client’s unanswered inquiries to company President Heather Cianfrocco about the test kits.

“Concerned that his confidential health care information may have been released in violation of HIPAA, Mr. Kleff wrote to Ms. Cianfrocco seeking an explanation of how Exact Sciences Laboratories obtained his information – if only his address and phone number – on October 18, 2023,” the letter said.

Who Wrote the Script?

Last Tuesday, Optum Medical Care/CareMount Health Solutions General Counsel Doris Varlese acknowledged receipt of the legal letter, and told Weddle a response would be forthcoming.

“Please do not communicate further with Mr. Clark regarding this issue,” wrote Varlese, who is affiliated with the local 90 S. Bedford Rd. CareMount location in Mount Kisco.

Despite all of his public and private protesting, Kleff received yet another unsolicited marketing call last Wednesday about taking the Cologuard test. He recorded the conversation.

“I want to know who prescribed the kit to be sent to me and my wife,” Kleff told me of his conversation with the representative. “And then she said, ‘Well, yes, your healthcare provider.’ I said, ‘Well, I talked to my doctor and he didn’t prescribe it. So who was it?’ She said, ‘Well, a physician within the group.’ So at the end, I kind of said, ‘Then I guess you can give me his name.’”

The representative then provided the name of Dr. Richard Morel, a local CareMount/Optum physician.

How can a doctor Kleff doesn’t even know responsibly write a prescription for him to take a Cologuard test he doesn’t need or want? Are Optum doctors asked to, in a sense, write prescriptions en masse to an entire demographic population for marketing purposes? Are they even aware?

I asked Kleff what his research leads him to believe about the broader issues.

“You do the test, the test will not cost anything,” he said in our interview last week. “But if the test comes back positive and you go to your doctor to have a colonoscopy to kind of prove it, that something is going on in your colon, many insurance companies will not pay for the colonoscopy because it’s a diagnostic test, which is not covered.”

Kleff observed how “obviously the money aspect is of importance.”

The money aspect, to state the obvious, is of utmost importance with every strand of this unfolding story about our local healthcare – and it’s the money we need to follow.

Keep in touch with your testimony.

Adam Stone is the publisher of Examiner Media. E-mail him at astone@theexaminernews.com with tips and feedback.

This article cites an anonymous source. Read our Best Practices page, developed in collaboration with The Trust Project, to review our related policies.

*We updated this article on the afternoon of Jan. 29 and again on Jan. 30 with additional detail.

Adam has worked in the local news industry for the past two decades in Westchester County and the broader Hudson Valley. Read more from Adam’s author bio here.