Tax Cap Could Lead to 20 Jobs Eliminated in Carmel Schools

If the Carmel Central School District is to remain within the confines of the new, state-imposed tax cap, 20 teaching, support staff and school resource officer positions will potentially have to be eliminated from the district’s 2012- 2013 spending plan next year. That was the news delivered by Superintendent James Ryan to the Board of Education at a preliminary budget meeting held on Feb. 14 at Carmel High School.

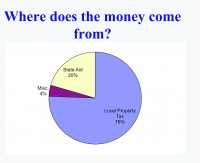

So that the public would fully understand the impact of the new legislation, it was explained that the new tax cap applies to the school district’s tax levy — or the total pool of money raised through school taxes on property owners within the district — and would not be a cap on the tax rate, or the actual annual percentage increase that will appear on the tax bills of property and homeowners inside the school district.

In addition, the so-called two percent tax cap is tailored to each school district using a formula provided by New York State.

In the case of Carmel Central School District, the cap on the amount the school district can raise the tax levy for next school year is 2.26 percent, Ryan said.

If the school district is to remain within the confines of the cap on the tax levy, next year’s budget would be limited to $109.9 million in spending, leaving a more than a $2.2 million gap for the estimated $112.2 million needed to retain all current programs and services.

“So that’s our challenge. It does present quite a battle,” said Ryan, noting that over the past two years the school district already had eliminated close to 70 positions district-wide.

To close that $2.2 million gap, a preliminary plan was presented calling for not filling 2.5 teaching positions vacated by retirement, eliminating three support personnel positions and six faculty positions for elective classes at the high school and middle school, some restructuring at the middle school, alternative high school and elementary schools for a reduction of another 6.5 full-time positions and the elimination of the two school resource officers at the middle and high schools.

In addition, the school district also would have to look to eliminate some student clubs and athletics, including modified and freshman sports and some junior varsity teams, to further close the more than $2 million gap.

The hypothetical alternative to that, Ryan said, could be to increase the tax levy an additional one percent above the state-mandated cap, which would require a “yes” vote from 60 percent or more of the school district residents who vote.

According to data provided by the school district, over the past three years, the “yes” votes from district voters did not exceed 56 percent.

Even with that 1 percent hypothetical increase in the tax levy above the dictates of the tax cap, Ryan said cuts to teaching and support staff positions would still be necessary, but to a lesser extent Board of Education President Richard Kreps said all of the numbers and cuts presented that night were preliminary and that nothing was set in stone. He urged the residents of the school district to participate in upcoming budget discussions.

“I feel people in the district need to have a say,” Kreps said.

Kreps also had a warning for residents regarding another element of the new tax cap legislation. In the past, if a school budget was voted down the first time, and then a second, a school district would revert to a contingency budget that allowed for a limited increase in spending that was based on state-mandated formula. That is no longer the case. If the spending plan put forward by the Board of Education in May is voted down twice, the new tax cap legislation dictates that a school district must go to a zero percent increase in spending and hold to the exact same budget from the previous school year.

In the case of the Carmel Central School District, this would mean the estimated $2.2 million budget gap that existed under the tax cap, would increase by an additional estimated $1.1 million, requiring even deeper cuts than the elimination of 20 faculty and staff positions and student athletics outlined earlier in the meeting by Ryan.

“If we go down twice [in the budget vote] … there is not going to be a lot left for a lot of people. It will impact every program in the district,” Kreps said.

Adam has worked in the local news industry for the past two decades in Westchester County and the broader Hudson Valley. Read more from Adam’s author bio here.