Home Guru: Housing Inventory, Sales and Mortgages

At least once or twice a year, I like to take a “snapshot” of the moment in the housing market as a sort of historical record, and the very promising developments in the past six months prompt me to do so now.

At least once or twice a year, I like to take a “snapshot” of the moment in the housing market as a sort of historical record, and the very promising developments in the past six months prompt me to do so now.

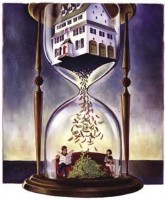

But first the bad news. While many signs in the market are pointing to happier days, the biggest challenge my associate realtors and I face today is the lack of housing inventory to satisfy the number of buyers who are out there right now, ready with cash in hand to buy. Where is the selection of houses they might have found as recently as last year?

Actually, they’re still coming on the market, but because the number of buyers has increased significantly in the past year, new listings are being absorbed more quickly and cannot keep pace with maintaining a healthier inventory. As a consequence, it’s slowing down the recovery of the market from what it might have been. But still, we don’t have a lot to complain about if buyers are on the hunt again.

This trend hit me a couple of times –and in the pocket–as buyer clients found the properties they wanted, only to be shut out by bidding wars. Yes, they’re back.

In a way, it’s strange that inventory is lacking, because so many sellers had been on the fence for such a long time, waiting for conditions to improve before listing their homes. That time is now, so where are those homes? We might see an improvement in this situation as the current market frenzy calms a bit with the seasonal adjustment that comes with cold weather.

Now for the really good news: according to third quarter reports of the Multiple Listing Service, both the Westchester and Putnam markets experienced a significant surge in sales. Westchester boasted an incredible 32.5 percent increase and Putnam experienced increased sales of 22.2 percent over the same quarter last year.

Here are some other trending prospects, as projected recently by bankrate.com.

As home prices have increased this year, many homeowners have gained more equity, and they may be tempted to cash out some of that equity to remodel their homes. They can do either a cash-out refinance or a home equity loan. But since mortgage rates jumped over the summer, home equity loans look more attractive to homeowners who don’t want to refinance with today’s rates.

At the same time, lenders are more willing to make home equity loans now that prices are rising. Does that mean homeowners will once again use their properties as cash machines? It doesn’t seem likely after what we’ve been through with the recession, learning for the first time in a long time that house prices that go up can go down again.

Mortgage standards will loosen for buyers. With increased mortgage rates, lenders will no longer see homeowners lining up to refinance mortgages. Their customers will now be homebuyers and to attract them underwriting standards will loosen up in the coming months. As Anthony Sanders, professor of real estate and finance at George Mason University observes for bankrate.com, “Banks have gotten crushed because of the decline in refinancing. Now that the cash cow has been milked, they have to build up their pipelines for purchases.”

By way of illustration, the average credit score for loans that closed in August had dropped to 734, according to Ellie Mae, the mortgage technology firm. That is the lowest score since the company started tracking data in August 2011. About 31 percent of the mortgages closed had a score below 700. Only a year ago, only 15 percent of loans fell below that point.

A good thing is happening for people who lost homes to foreclosure or short sale in the past few years. If these people can show that a job loss or reduction in income was responsible, they can apply sooner for an FHA-insured mortgage. Previously, the FHA required a three-year wait after foreclosure to apply for a new loan, but the FHA now makes exceptions, shortening the wait to one year.

Finally, there’s more good news. Economists are projecting that mortgage rates are likely to take a break this winter and will not bounce out of the 4.3 to 4.8 percent range.

So things are pretty good on the home front, wouldn’t you say?

Bill Primavera is a Residential and Commercial Realtor® associated with Coldwell Banker, as well as a publicist and journalist who writes regularly as The Home Guru. For questions about home maintenance or to engage him to help you buy or sell a home, he can be emailed at Bill@TheHomeGuru.com or called directly at 914-522-2076.